If you’ve ever wondered “Why do we even need a 409A valuation?” — you’re not alone.

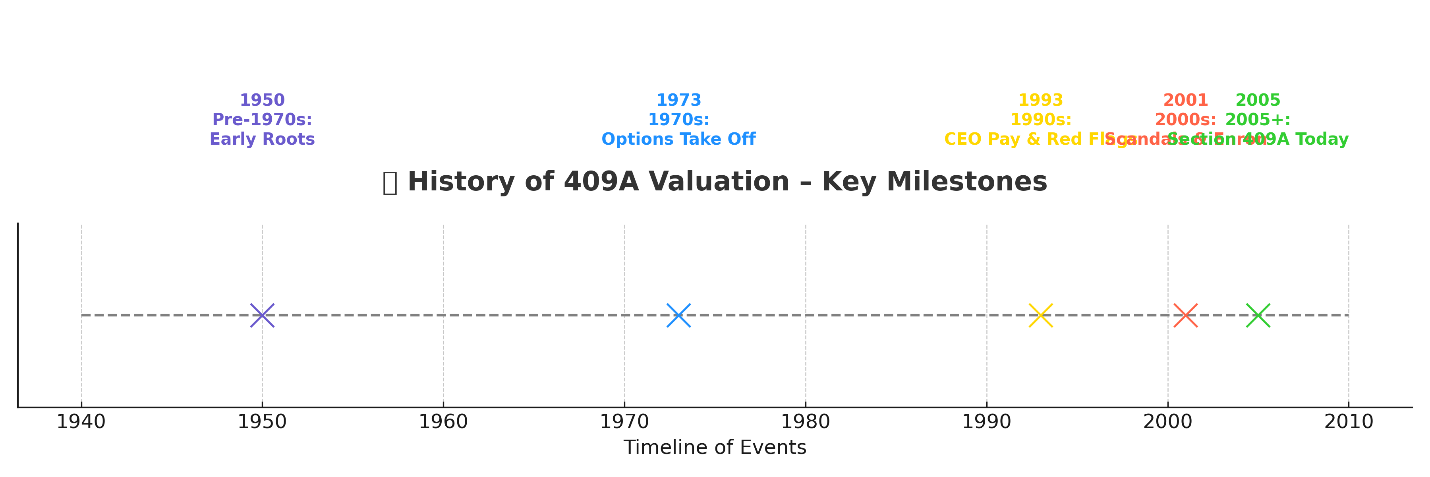

Like Rome, the 409A rule wasn’t built in a day. It was shaped by decades of accounting rules, stock market innovations, executive pay scandals, and finally, reforms. Let’s take a journey through history to understand how 409A came to life. Our story starts with the history of Stock Options.

Pre-1970s: The Early Roots of Stock Options

Stock options have a surprisingly long history, evolving from informal trading practices to standardized contracts.

- Ancient Greece: Early option-like agreements were tied to agricultural goods.

- 16th–18th Centuries: In Europe, especially in Antwerp and Amsterdam, traders used contracts similar to options for commodities and forward deals.

- 1920s (U.S.): “Bucket shops” allowed speculation on stock prices, acting much like bookmakers for options-like contracts.

- 1950: The Revenue Act of 1950 made stock options especially attractive by allowing executives to pay the lower capital gains tax rate instead of ordinary income tax. This sparked the use of employee stock options as a major compensation tool.

By the late 20th century, options had moved from markets and speculation into the heart of corporate pay structures — setting the stage for later reforms.

1970s and 1980s: The Foundation of Stock Option Accounting

In the early 1970s, the Accounting Principles Board (APB), which preceded the Financial Accounting Standards Board (FASB), was tasked with determining the appropriate accounting treatment for the issuance of stock options.

In 1972, the APB issued APB 25, which allowed companies to measure stock option costs by “intrinsic value” (market price – exercise price).

- If options were issued at market price, companies recorded no expense at all.

That didn’t last long. In 1973, the Black-Scholes model changed the game, and with the launch of the Chicago Board Options Exchange, stock options became mainstream in executive and employee pay packages.

In 1983, the FASB began a review of stock option accounting, which was an early step toward addressing the exploitation of the system.

The 1990s: CEO Pay and the First Red Flags

Fast forward to the 1990s — CEO salaries had ballooned.

In 1993, the IRS introduced Section 162(m), which limited a public company’s corporate income tax deduction to $1 million per year for amounts paid to each of its top five executives. As a result, companies began compensating executives with stock options instead of higher salaries. This approach allowed executives to pay capital gains taxes on stock-based compensation rather than income taxes, and companies could conserve cash. Additionally, since stock-based compensation was regarded as performance-based, it remained tax-deductible for the company.

This led to companies issuing more stock options to both executives and lower-level employees, as they didn’t have to record the options as an expense.

In 1995, the FASB introduced SFAS 123, suggesting companies should record the fair value of options. But since it was optional, most ignored it — keeping reported costs at zero.

This environment, combined with a strong bull market, led to the option backdating scandal.

The Option Backdating Scandal

Here’s where things went wrong.

Many companies started backdating stock options — choosing grant dates when their stock was at its lowest, ensuring instant profits for executives.

For example:

- If options were dated at $20 instead of $30, and the stock rose to $50, executives made an extra $1M.

- A Wall Street Journal study found this “luck” happened too often to be chance — the odds were 1 in 300 billion.

This was easy to do because there was no requirement to record expenses for options and companies had up to six months or even a year to disclose when options were issued. This practice was a way for executives to profit at the expense of shareholders and employers.

Enron and the Final Push

The Enron scandal in 2001 was a major catalyst for change. When Enron collapsed in 2001, another loophole surfaced: deferred compensation plans.

- Executives shifted income into special accounts, which they could withdraw anytime (with just a 10% penalty).

- Even during bankruptcy, many walked away with millions while shareholders lost everything.

This public outrage became the final push for reform.

The Road to 409A

Here’s how regulations evolved:

- 2002 – Sarbanes-Oxley (SOX): Required real-time disclosure of stock option grants, and the SEC issued rules requiring disclosure within two business days.

- 2003 – SEC: The New York Stock Exchange and Nasdaq required shareholder approval for nearly all equity compensation plans.

- 2004 – FASB (SFAS 123R / ASC 718): Stock options now had to be recorded as expenses.

The first AICPA guidelines for valuing privately held company equity securities were also published. These guidelines discouraged “rules of thumb” and emphasized the need for high-quality, objective valuations.

- 2005 – Section 409A Introduced: This new section took away the ability to use concepts like the haircut provision for non-qualified benefits and placed strict regulations on how executives could defer and withdraw money.

- 2006 – SEC: The SEC proposed requiring public companies to disclose the fair value of options on the grant date, as determined by the new accounting rules.

The cumulative effect of these changes led to a significant drop in stock option grants. This long history of scandals and regulatory responses ultimately led to the development and adoption of the 409A valuation as it’s known today, designed to ensure fairness and prevent abuses.

Why 409A Matters Today

The scandals of the past revealed just how easily stock options could be abused. Section 409A was introduced to bring back trust, transparency, and fairness.

Today, a proper 409A valuation is more than just compliance:

- It protects your company.

- It ensures fair treatment of employees.

- It strengthens investor confidence.

In short, good businesses are built on fair valuations.

About Sharp 409A

Don’t let the complex history of 409A slow your growth. Sharp 409A is your trusted valuation partner, offering fast, accurate, and audit-ready 409A valuations. We understand the pressure of running a startup, which is why our streamlined process is designed for a speedy turnaround, ensuring your company remains compliant and your focus stays on what matters most: building your business. Trust Sharp 409A to handle your valuation with the expertise and efficiency you deserve.

Note* “This information is not intended as legal advice and should not be considered a substitute for consulting with an attorney regarding your specific situation. Please contact a lawyer for professional guidance on any legal matters.”

Sharp 409A

Founded in 2014, Sharp 409A began with a mission to simplify 409A valuations for global startups. With 15+ years of experience, a presence in 13+ countries, and over 1,000 valuations covering assets worth 200B+ USD, we deliver independent, IRS-compliant, audit-ready fair-market value reports that companies can confidently rely on.