First of all, what is a 409a valuation? The Section 409A regulation of the United States Internal Revenue Code (IRC) mandates that a private company cannot issue non-qualified deferred compensation (e.g. stock options, SARs, etc.) to employees below the Fair Market Value (FMV). Stock options need to be issued at or above fair value in order to avoid significant tax penalties, including federal and varying state tax penalties. Again, the FMV should ideally be determined by an independent third party valuation firm in order to qualify for safe harbor under Section 409A of the IRC. 409A valuations should be performed annually or if the company has a material event such as new financing. Read more

Now, what are the scenarios where Indian companies may need to get a 409a valuation done? India has a unique startup ecosystem. There has been a tremendous encouragement for entrepreneurship from the current Prime Minister Narendra Modi through his different initiatives.

India is now the third largest startup ecosystem in the world and is home to 100 unicorns as per a keynote by current Indian ambassador to the United States Taranjit Singh Sandhu. Most of the Indian startups have close connections with the US. Many entrepreneurs from India have either travelled or studied in the US or have been inspired from the US. A lot of Indian startups have employees and/or offices in the US. While doing so these Indian startups need to be compliant with the tax & regulations of the US.

Quick Questions for Indian companies

- Did you hire a U.S. citizen?

- Do you have an office in the U.S.?

If you said yes to either of these questions and are planning to grant deferred compensation (eg: ESOPs) then you will need to do a 409a valuation. The cost of purchasing a share is determined by this valuation.

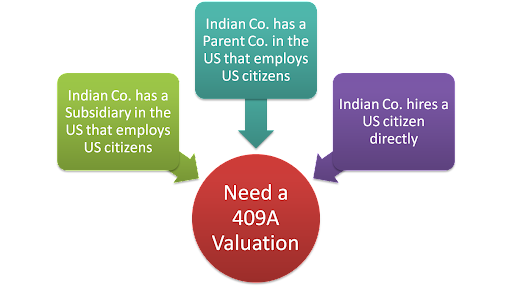

Suppose an Indian company hires a US citizen in one of the following three ways:

Moreover, the Indian company wants to issue non-qualified deferred compensation (ESOPs for example) to the US citizen. In such a situation, the company would need an IRC 409a valuation from an independent appraiser. This is to ensure that the strike price of the options issued is more than the fair market value of the company. Any company failing to comply with IRC 409a regulation may attract severe penalties for its employees.

Let us further elaborate with an example:

Say company ABC which is an Indian company hires Bob — a U.S. citizen to work in India or in its subsidiary in the U.S., and offers ESOPs to Bob under its India plan. Then company ABC will be required to comply with 409A as it relates to Bob. Therefore, Indian startups with U.S employees must ensure they comply with the regulations of section 409A of the IRC. Read more

In case of non-compliance with 409a there can be severe penalties for the company and the employees as well.

We at Sharp 409A are specialists in providing 409a valuations. Our experts have more than a decade of experience in just 409a valuations. We have performed 409a valuations for several such Indian companies as well.

Get high quality IRC 409A Valuation quickly at an affordable cost. Our 409A reports are audit-proof. For more details, checkout our pricing.

Disclaimer

Sharp 409A is neither a law firm nor provides legal advice. Before making decisions on matters covered by this post, readers should consult their legal adviser.